Media

What makes Short-Term European Power Market Surveillance So Difficult?

As the SIDC market infrastructure matures over time, the exchanges may work to make such information available as standard. What makes Short-Term European Power Market Surveillance So Difficult? This poses many questions and presents challenges from a transaction surveillance perspective. Without product history there simply cannot be a transaction surveillance calculation. Another consideration is the active and increasing role played by algos and how this might induce your traders to undertake potentially abusive behaviour in the context of the SIDC market design. Some of these challenges emanate from unique market design features and others from the complexity, completeness, and quality of the available transaction data. The Ephemeral Nature of Intraday Products For transaction surveillance solutions to be effective they require transaction data history.

CubeLogic launches real-time cloud native VAR (value at risk) engine

London, November 8, 2022- CubeLogic launches a real-time cloud native parametric VAR (value at risk engine) to help energy and commodities trading firms to quantify, visualize and control their market exposure across the entire portfolio. CubeLogic is an industry...

Dodd-Frank Position Limits – A year of living dangerously

As the first anniversary of Dodd-Frank position limits approaches, we reflect on the prospect of enforcement by the CFTC and the many challenges energy and commodity trading firms continue to face in effectively managing this risk.

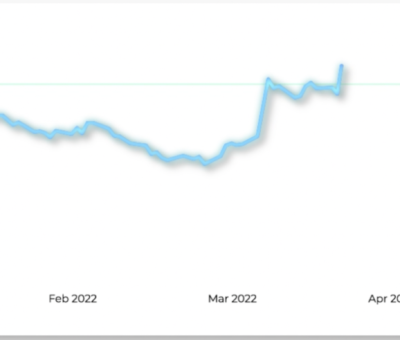

European Energy Markets in Turmoil – What does this mean for compliance monitoring in power and gas markets?

European power and gas markets are in a state of unprecedented turmoil given disruption to supplies of Russian gas and the ongoing outages in France’s nuclear generation fleet. So severe is this turmoil that many are questioning whether the market itself is still viable and its long-term survival is not guaranteed. So far however, European politicians have not seriously contemplated extreme measures such as the wholesale suspension of the market but even the less invasive measures currently being debated are still likely to have a significant impact on the overall market structure and how firms trade power and gas. But what does this mean for compliance, and in particular those who are tasked with monitoring their traders’ activity for market abuse under REMIT1 and MAR2?

CubeLogic Summer 2022 Newsletter

All the latest from CubeLogic Thoughts from Lee Campbell, CEO It’s been a busy start to the year for CubeLogic with several large global credit implementations in-flight alongside welcoming several new...

CubeLogic named the Energy Technology Firm of the Year for a second consecutive year

London, June 1, 2022- CubeLogic is named an Energy Technology firm of the year by Energy Risk Awards 2022 for its advanced credit risk management software platform RiskCubed, which has been enhanced with complex data and analytics. CubeLogic is an industry leader in...

E-World 2022

After a long wait the leading trade fair for the Energy industry,E-World Energy & Water, is back!...

Commodity Trading Week Americas 2022

The CubeLogic team are pleased to announce our sponsorship of Commodity Trading Week Americas Houston, Texas. Date: 8th - 9th June 2022 Our very own Roderick Austin will be in attendance at this year's event event hosted by Commodities People. This inaugural event is...

29th IECA Annual Canadian Conference

The CubeLogic team are proud to be platinum sponsors of the 29th IECA Annual Canadian Conference in Banff, Alberta. Date: 5th - 8th June 2022 Our very own Roderick Austin will be in attendance at this year's event event hosted by the International Energy Credit...