CubeLogic Summer 2022 Newsletter

Summer Newsletter 2022

It’s been a busy start to the year for CubeLogic with several large global credit implementations in-flight alongside welcoming several new clients in our Credit and  Compliance verticals. We have seen increasing demand for our flagship enterprise credit risk solution, and given recent acquisition events, we are now proudly the only truly ETRM-independent solution for Energy and Commodities in the marketplace.

Compliance verticals. We have seen increasing demand for our flagship enterprise credit risk solution, and given recent acquisition events, we are now proudly the only truly ETRM-independent solution for Energy and Commodities in the marketplace.

Many of our clients have had to directly contend with the dramatic events in Ukraine and the knock-on effects it has on global markets, energy supplies and how to manage and mitigate the risks and challenges that this entails. Our solutions are flexible and on hand to measure and monitor the impacts with accurate information to enable risk teams to meet the demand for information and analysis.

We’ve also managed to have our first face to face events post covid more recently, which has been hugely beneficial for both us and our clients. It’s been great to spend time with our clients and partners and discuss their challenges and how we can work together in the future.

As we look to the second half of the year, we continue to invest in expanding our team and our core solutions with many new product releases imminent. I’m genuinely excited to bring our new real-time Market Risk VaR product to market after a swift and successful implementation at our first client in this area. Also look out for v9 of the core credit platform in the coming months. In addition, the growth of our compliance solutions has been especially strong, and I am putting in place significant investment this year, with plans to double the size of the compliance team over the coming months.

It was also wonderful to win the coveted Technology House of The Year award from Energy Risk for the second year running. This is a great honour and is testament to all the hard work the team has put in over the last twelve months. I would also like to that our clients for their continued support and I look forward to a successful second half of the year.

Announcements

New Clients and Successful Projects

The first six months of 2022 have seen continued high levels of activity from our Global Professional Services team. This is in support of an even broader mix of activities in our delivery portfolio. These range from multi-year, multi-product implementations at global organisations through to discrete customisations for our ever-increasing existing client base.

Recent releases of RiskCubed have enabled the team to work towards delivering more standard product-based solutions across new and existing clients. The steady schedule of upgrades (to version 8.x) also allows clients to benefit from the improvements being continually made to RiskCubed.

New client sales have increased our portfolio yet further with several multi-national organisations being added to our client base. We continue to see an increase in clients taking our Trade Surveillance offering including several existing Credit clients expanding their use of the CubeLogic product set. With the introduction of CubeCalcFE and the new CubeCalcVR to the product set, we expect this to expand even further.

Alongside upgrades and enhancements, we have also seen an increase in the number of clients (both existing and new) moving to CubeLogic’s SaaS offering.

The remainder of 2022 shows no sign of slowing down and we are continuing to build our Professional Services team size and capability to meet demand.

ISO Certification and process improvements

Compliance Certifications and Audits in 2022 are completed along with ISO 27001 and ISO 9001 Certification for Q1 2022 and SOC 2 TYPE II audit for H1 in 2022.

Product Releases

Credit Risk: V9 release announcement and its contents

Another milestone for CubeLogic with the release of version 9 of the RiskCubed Suite. Building on the version 8 framework we have continued to make improvements to the usability, look and feel of the system. This release also introduces exciting new features that bring more flexibility to business process design and enhancements of the existing modules.

Below are some of the key new features that you can find in this release:

Limit Management: The limit management user interface has been enhanced to support a 4 eyes validation check. This check is integrated with the RiskCubed workflow functionality to couple two key components of the CubeLogic framework. This allows the user to create more custom approval processes within the user interface screens. The Limit Management UI is the first iteration of a more closely coupled UI and workflow.

Additional enhancements have been made to support the setting of limits across calendar and tenor time periods bringing greater flexibility to the limit allocation process.

Real Time Pre-Deal Check (PDC): The PDC process has been reworked to provide a cleaner and quicker user experience. A new processing engine has been developed that takes the deal entry from the user, incorporates it into the forward exposure profile and then returns the results which can be displayed back to the user.

In conjunction with this, enhancements have been made that allow for the embedding of reports within the workflow screens. These are used to great effect in the standard PDC workflows, to allow easier analysis of the results but can be included in any workflow.

Data Transformation Engine: The first phase of the data transformation engine has been completed which brings a technical framework that can be built upon in future versions. The framework brings a structured phase one user Interface design as well as well as the core technical components that will allow us to build multi step processing of rules, amendments to existing data fields based on user defined criteria as well as scheduling and trigger capabilities.

PFE Integration: The Credit Cube has always has the capacity to load and display PFE details as part of the overall Credit exposure. In v9.0 this is complemented with a set of configuration screens, workflows and integrations that allow a PFE engine to be fully managed from within the RiskCubed user interface. This integration is designed to be agnostic to the PFE engine you want to integrate and will support you whether you choose to use CubeLogic’s own CubeCalcFE engine, an engine you build in-house or a third party engine including the offering of out partners at Numerix.

Continued User Experience Improvements: We continue to make general user experience updates to the system based off the feedback that we have received through a variety of custom forums.

Compliance Risk

CubeWatchTS

CubeLogic is pleased to announce the new web-based UI for CubeWatchTS is available with Release v8.0. The CubeLogic team invested significantly in providing our customers a modern and much-improved user interface and will continue to- do so in the future. The new web-based UI is already in productive use by CubeWatchTS users and CubeLogic will work with all remaining users to also roll-out the new web-based UI for them soon. We are also happy to share that our Compliance customer base is growing further and that we onboarded and are in the process of onboarding additional customers to our SaaS platform.

CubeWatchPL

With the new v9 of CubeWatchPL, CubeLogic is pleased to announce that the full scope extension to address the Dodd-Frank requirements is now available to our customers. Respective functionalities have been built impacting: the Engine, UI, Dashboard, Workflows and Reports. Key next step will be the extension of CubeWatchPL’s exchange coverage.

Market Risk

Launching CubeCalcVR

CubeCalcVR is a real time VAR engine that can source data via API from trade capture systems to satisfy the growing demand from customers for ultra-fast real –time risk assessment of trading portfolios. Parametric VAR, being purely analytical with no time-consuming simulation involved, is well suited for true real-time risk engine. VAR is incrementally and instantly refreshed as prices and positions are updated. Correlations between all the curves are automatically updated and used to compute VAR alongside the trade data. Our solution requires about 90 days of history and is fast, real time and lightweight. It is well suited for commodities markets due to common issues with time series data quality and its seasonal nature; only taking into account 2-3 months of data you cope with trends and market events faster. When your portfolio consists of linear transactions, parametric VAR is accurate and the fastest model to calculate risk.

CubeLogic Partnerships

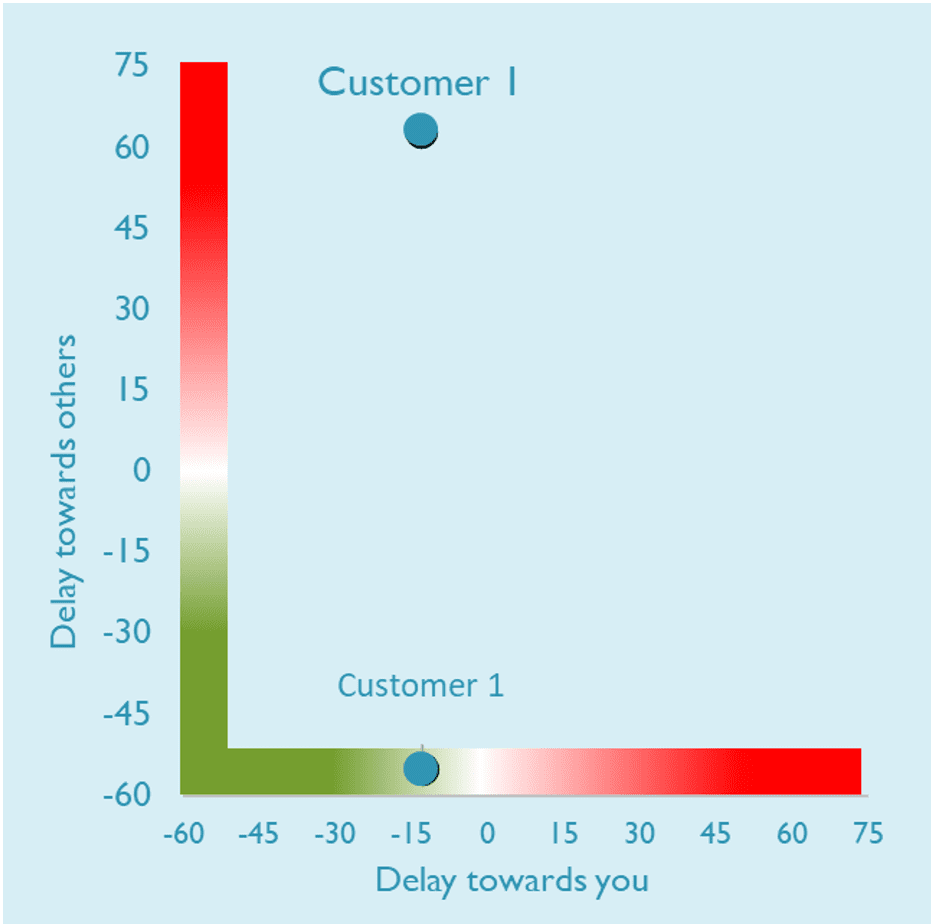

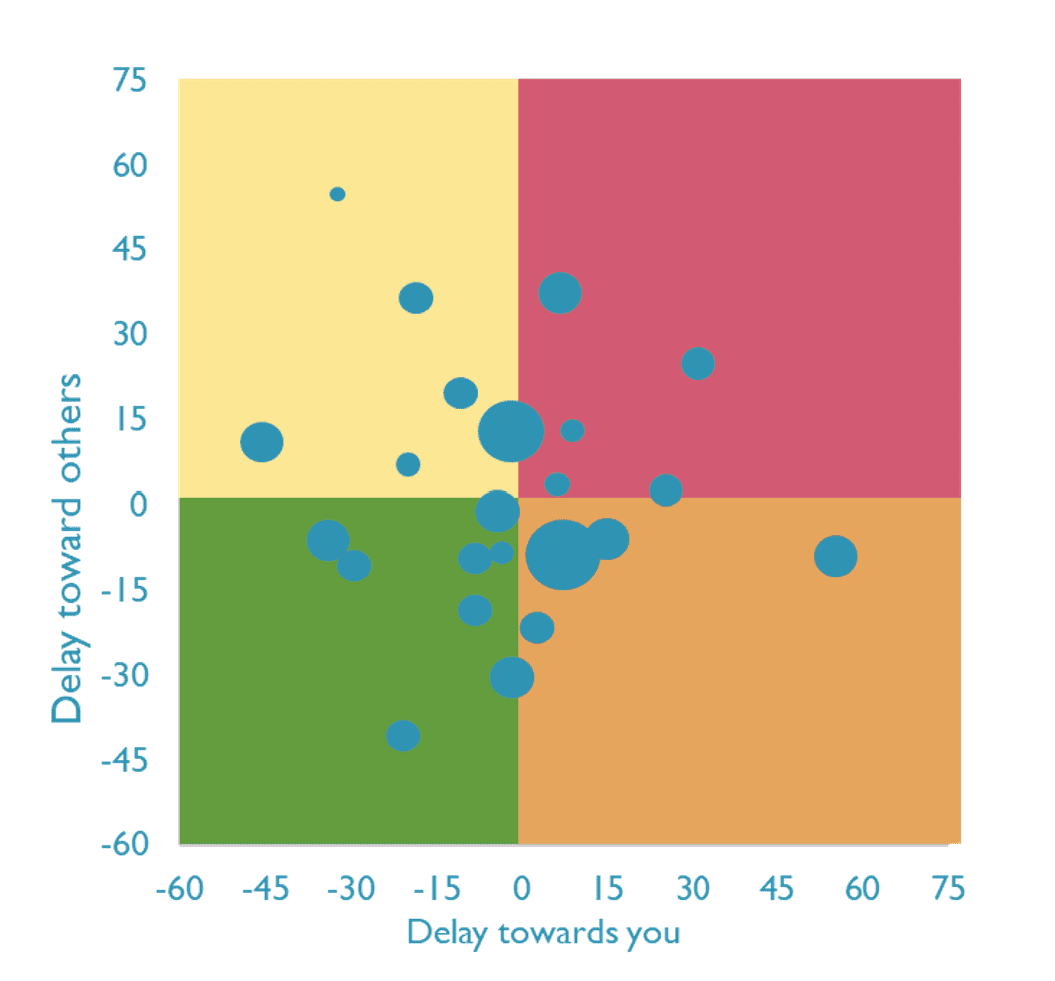

Partnerships are a core part of our strategy to continually improve our products and to provide you, our valued clients, with additional features and services. It is therefore with pleasure that we can announce a new and unique partnership with Dun & Bradstreet that we believe will be of great interest and value. We have joined forces with D&B’s Global DunTrade programme which is the world’s largest pool of invoice payment history providing insight into other companies’ external payment behaviour. CubeLogic has negotiated exclusive access to this huge dataset for the purpose of incorporating it into our Cash Collections module. This will enable users of the RiskCubed platform to monitor their counterparties creditworthiness based on their external payment behaviour. For example, if a counterparty is currently seen as a good payer with respect to your invoices but exhibits a material deterioration in payment performance externally then this information can be incorporated into Early Warning alerts and even a credit score. Portfolio analysis can also be performed highlighting hotspots in the portfolio which might merit enhanced monitoring and due diligence.

In addition, we have also negotiated exclusive access to free D&B Credit Risk and ESG reports, as well as ESG self-assessment tools, for CubeLogic clients that participate in the free Dun Trade programme.

The CubeLogic Gallery

E-World

Summer Networking Event

CubeLogic Social

US User Group

Latest media

Follow the links below for our latest blogs, events and press releases.